Much like their counterparts on the Republican side, Democrats are beginning to pay attention to how the party Establishment is working hard to muzzle anyone who might not be going along with their predetermined agenda on how this election is supposed to go.

After all let's not forget that there are Wall Street Billionaires and Millionaires that are chomping at the bit to call in all those IOU's they piled up with Hillary for those highly compensated speeches she doesn't want to talk about.

Let's also not forget that Hillary and her hubby are Millionaires themselves and card carrying members of the 1% Club.

As Clinton tries to talk tough about how she will stand up to America's biggest banks, her Democratic rivals are likely to remind voters just how cozy she's been with Wall Street.

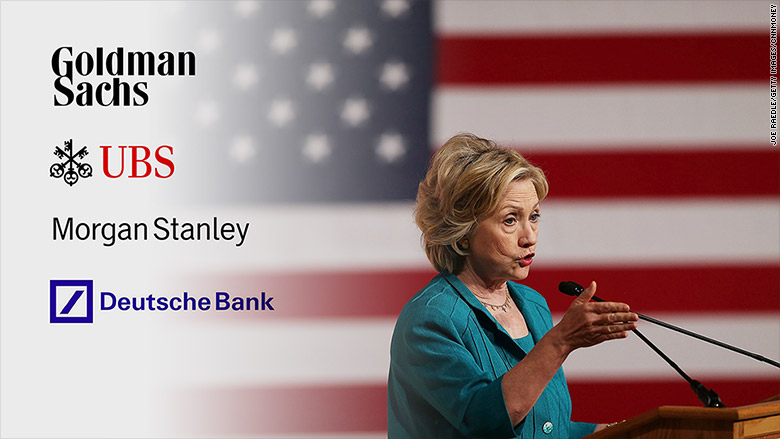

Clinton made $3.15 million in 2013 alone from speaking to firms like Morgan Stanley, Goldman Sachs, Deutsche Bank and UBS, according to the list her campaign released of her speaking fees.

"Her closeness with big banks on Wall Street is sincere, it's heart-felt, long-established and well known," former Maryland Governor Martin O'Malley has said on the campaign trail.

While Clinton has given paid speeches to many groups, Wall Street banks and investment houses made up a third of her speech income.

She even made more money speaking to UBS and Goldman Sachs than her husband Bill did. Goldman Sachs in New York paid Bill $200,000 for a speech in June 2013 and Hillary $225,000 for a speech in October of that year.

Clinton's Wall Street ties likely to be debate issue

"If the other candidates want to make this an issue, they've got plenty of material," says Larry Sabato, director of the University of Virginia Center for Politics.

Sanders, for example, has been outspoken that the big banks are still "too big to fail" and should be broken up.

Clinton's anti-Wall Street policies stop far short of that, with proposals to tax short-term trading and impose a "risk fee" on big banks with assets over $50 billion.

Wall Street's reaction to her plan to regulation big banks was mostly a sigh of relief.

"We continue to believe Clinton would be one of the better candidates for financial firms," one analyst wrote.

Related: Wall Street isn't worried about Hillary Clinton's plan

Wall Street has been a top supporter of Clinton's career

As a former senator from New York, it is not surprising that Hillary Clinton would have a close connection to the financial world. But Wall Street continues to be a big contributor to her political career.

In her 2008 run for president, JPMorgan (JPM), Goldman Sachs (GS), Citigroup (C)and Morgan Stanley (MS)employees were among her top campaign contributors, according to the Center for Responsive Politics.

Tabulating campaign contributions for her entire senate political career shows that four of the top five her contributors are Wall Street banks (Citigroup, Goldman Sachs, JPMorgan and Morgan Stanley).

In contrast, Sander's career campaign contribution list is almost entirely made up of union groups.

No comments:

Post a Comment