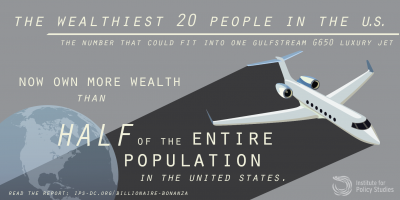

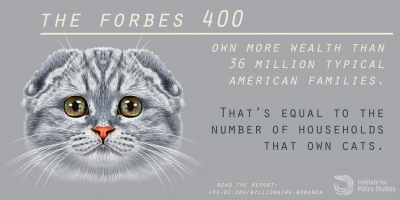

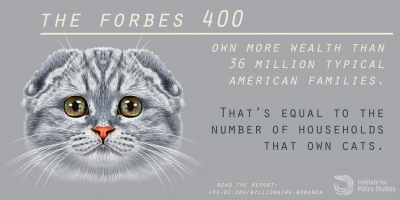

America’s 20 wealthiest people — a group that could fit in one Gulfstream G650 jet — are now worth $732 billion, which means they have more wealth than the 152 million people who make up the least wealthy 50% of U.S. households, according to a report released Wednesday by the Institute for Policy Studies. What’s more, the “Forbes 400” wealthiest individuals in the U.S. now have a net worth of $2.34 trillion.

“There is a growing concentration of wealth in fewer and fewer hands,” says Josh Hoxie, who heads up the Project on Opportunity and Taxation at the institute.

The report’s co-authors — Hoxie and Chuck Collins, a senior scholar at the Institute for Policy Studies, a Washington, D.C.-based think tank that focuses on economics, national security and human rights — propose several ways to close the gap between America’s ultra-wealthy and, well, everyone else. These policies include closing offshore tax havens and loopholes for the ultra-wealthy in the tax code that the wealthy exploit to hide their wealth. One of the biggest billionaire loopholes is the Grantor Retained Annuity Trust, which enable very wealthy families to pay little if any estate and gift tax on estates worth billions of dollars, Hoxie says. “There’s no reason why it should be used as a tax evasion mechanism,” he says. “It’s an unintended result of our tax code.”

He also proposes a direct tax on wealth to generate trillions of dollars in new revenue.

“There is a growing concentration of wealth in fewer and fewer hands,” says Josh Hoxie, who heads up the Project on Opportunity and Taxation at the institute.

The report’s co-authors — Hoxie and Chuck Collins, a senior scholar at the Institute for Policy Studies, a Washington, D.C.-based think tank that focuses on economics, national security and human rights — propose several ways to close the gap between America’s ultra-wealthy and, well, everyone else. These policies include closing offshore tax havens and loopholes for the ultra-wealthy in the tax code that the wealthy exploit to hide their wealth. One of the biggest billionaire loopholes is the Grantor Retained Annuity Trust, which enable very wealthy families to pay little if any estate and gift tax on estates worth billions of dollars, Hoxie says. “There’s no reason why it should be used as a tax evasion mechanism,” he says. “It’s an unintended result of our tax code.”

He also proposes a direct tax on wealth to generate trillions of dollars in new revenue.

No comments:

Post a Comment